20+ mortgage debt ratio

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Find out what debt-to-income ratio is and how you can lower it.

What Does Debt To Income Ratio Mean Guidance For First Time Home Buyers Mortgage Solutions Financial

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

. Apply Get Pre-Approved Today. Ad Weve Researched Lenders To Help You Find The Best One For You. If your gross income for the month is 6000 your debt-to-income.

A 20 down payment is ideal to lower your monthly. What factors make up a DTI. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Iklan Tengah Artikel 1. Save Real Money Today. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

A down payment of. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web Understanding Debt To Income Ratio For A Mortgage Nerdwallet Bagikan Artikel ini.

This should be 20 or less of net. Get Instantly Matched With Your Ideal Mortgage Lender. In this formula total monthly debt.

Web Web Your debt-to-income ratio for mortgage applications is one of the most important factors lenders consider. Web If you have a lower credit score or higher debt-to-income ratio your mortgage lender may require at least 20 down for a second home. Select Region United States.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web What is debt-to-income ratio and why does it matter when you apply for a mortgage.

Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3. But with a bi-weekly. Most home loans require a down payment of at least 3.

Lower your debt-to-income ratio. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Its helpful to understand how different ranges can impact your chances of.

Posting Lebih Baru Posting Lama Beranda. However some of those methods can be costly. Web 2 days agoOn a 20-year mortgage refinance the average rate is 693 and the average rate on a 5.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web This compares annual payments to service all consumer debtsexcluding mortgage paymentsdivided by your net income. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Lock Your Rate Today. Save Time Money. Web How to figure out your debt-to-income ratio To determine your debt-to-income ratio also called your back-end ratio start by adding up all your monthly debt.

Web Divide Step 1 by Step 3. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent.

Skip to content Main. Ad Review 2023s Top Rated Home Lenders. Ad Compare the Best Home Loans for February 2023.

Thats your current debt-to-income ratio. Web The amount of money you spend upfront to purchase a home. Web Heres how the debt-to-income ratio is calculated.

Web Banks dont typically accept credit card payments for mortgages directly but there are ways to do it. Comparisons Trusted by 45000000. Web Your debt-to-income ratio DTI measures your total income against any debt you have.

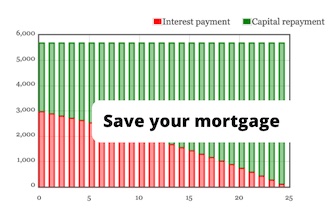

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Fha Mortgage Delinquencies Hit 17 5 In 30 Metros Over 20 On The Other Side Of A Red Hot Housing Market Wolf Street

10 Golden Rules To Follow When Taking A Loan

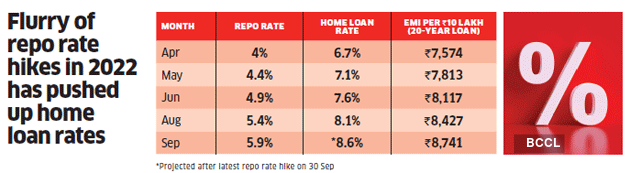

Rising Interest Rates Mean A 20 Year Home Loan Will Take 25 Years To Repay What Borrowers Can Do The Economic Times

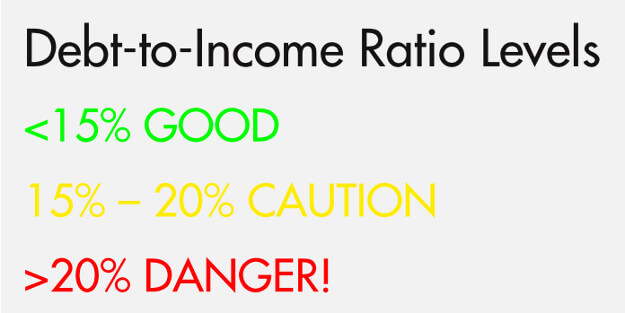

What Is A Good Debt To Income Ratio Anyway Clearpoint

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Partially Disaggregated Household Level Debt Service Ratios Construction Validation And Relationship To Bankruptcy Rates Elvery 2020 Contemporary Economic Policy Wiley Online Library

The State Of The American Debt Slaves Q2 2020 The Credit Card Phenomenon Wolf Street

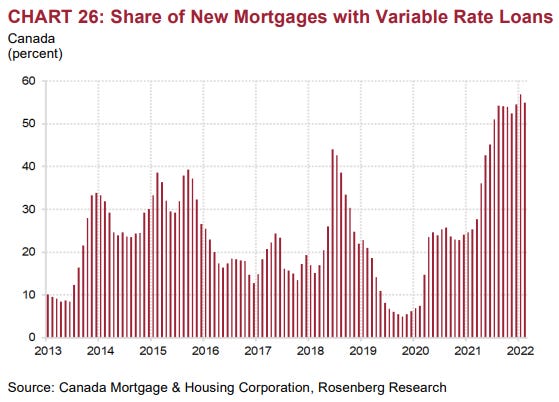

Making Hay Monday August 22nd 2022 By David Hay

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

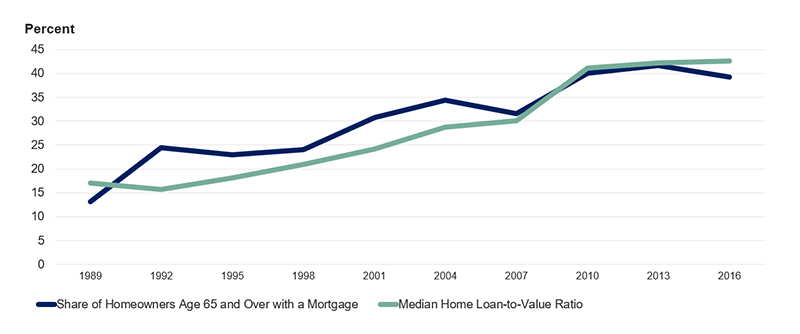

Leverage Ratios For U S Households Loan To Value Ltv Versus Debt To Download Scientific Diagram

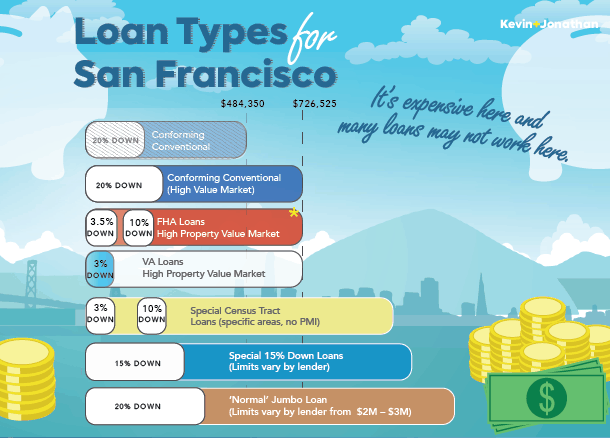

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

2 To 4 Unit Home How To Buy A Multi Unit Property

What Is The Debt To Income Ratio For A Mortgage Freeandclear

As Mortgage Rates Begin To Bite Home Sales Fall To Lowest Since June 2020 Supply Rises For Second Month Wolf Street